In recent years, China has taken bold steps to make

healthcare more affordable and equitable. One of the most impactful moves in

this direction is the inclusion of medical devices under insurance

reimbursement schemes, driven by mandates from the country’s central health

authorities.

By aligning device coverage with public health priorities,

China is not only reducing out-of-pocket costs for patients but also reshaping

how medical technology companies operate in its vast and complex healthcare

market.

Reimbursement Reform Backed by Strong Policy

The foundation for this shift comes from China’s 14th

Five-Year Plan (2021–2025), which outlines a national strategy to improve

access to essential health services under the Healthy China initiative. A key

part of this plan is the requirement that a growing share of high-value medical

devices be included in insurance reimbursement mechanisms—with a target of 80%

of hospital device expenditure to go through volume-based tenders by 2025.

At the heart of this policy is the dual objective of:

- Making

essential medical technologies more accessible and affordable

- Controlling

public healthcare expenditure through centralized procurement and

reimbursement alignment

Volume-Based Procurement (VBP): Driving Down Prices

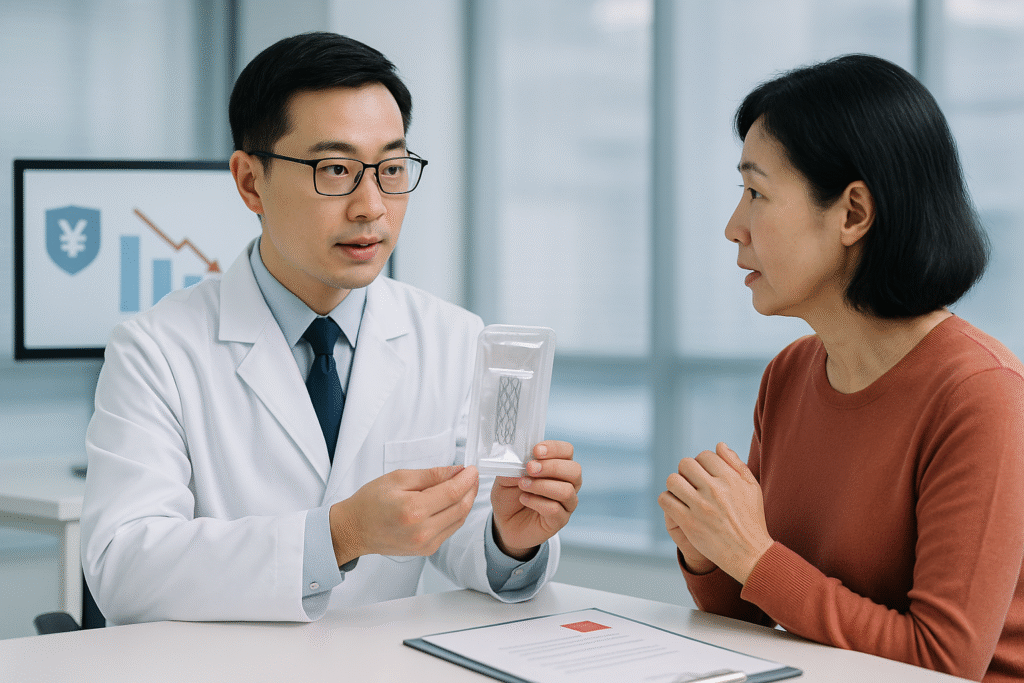

China’s Volume-Based Procurement (VBP) system, introduced

for medical devices in 2019, has dramatically changed the reimbursement and

procurement landscape.

Here’s how it works:

- Devices

are tendered in bulk across provinces or nationally.

- Companies

winning tenders are assured high sales volumes, but must offer significantly

reduced prices.

- Once

awarded, these devices are included in the reimbursed product list,

allowing hospitals to claim costs through public health insurance.

Examples of price reductions under VBP tenders:

- Coronary

stents: Up to 95% price drop

- Joint

replacement systems: ~82% reduction

- Spinal

and orthopedic implants: Over 80% cut in price

Once these devices are awarded under VBP, they become eligible

for reimbursement through China’s public insurance system, such as the Basic

Medical Insurance (BMI). This means patients pay significantly less, and

hospitals are reimbursed based on standardized prices.

Health Authorities Take the Lead

China’s National Healthcare Security Administration (NHSA)

has played a central role in this transformation. Acting as both the payer and policy-maker,

the NHSA ensures that medical devices procured under VBP are also

reimbursable—bridging the gap between procurement policy and patient access.

By linking reimbursement eligibility to VBP inclusion, the

NHSA ensures:

- Devices

meet clinical effectiveness and cost-efficiency thresholds

- Pricing

is transparent and consistent

- Hospitals

are incentivized to use listed, reimbursed devices

This has created a highly coordinated system where

procurement, pricing, and insurance are fully aligned.

Challenges for Medtech Companies

For medical device manufacturers—especially global

companies—this policy shift hasn’t come without challenges.

- Revenue

Pressure: Massive price reductions under VBP have significantly reduced

profit margins.

- Operational

Strain: Tenders are fast-moving, and companies must be ready with

resources and documentation at short notice.

- Strategic

Realignment: Many companies are adjusting their business models by:

- Partnering

with local manufacturers to reduce production costs

- Outsourcing

non-core components

- Focusing

on post-sale service instead of aggressive sales models

Some companies, such as Medtronic and Alcon, have reported

notable declines in their China sales due to VBP. In some cases, companies have

even exited certain segments of the Chinese market altogether.

The Opportunity in Compliance

While VBP and reimbursement mandates pose challenges, they

also open doors for companies that can:

- Demonstrate

cost-effectiveness

- Offer

localized production

- Provide

clinical value at reduced prices

- Respond

quickly to tender timelines

Importantly, Chinese patients continue to show preference

for international medical devices, especially if they are affordable and

reimbursed. This gives global medtech players an opportunity to retain trust

while adapting to the new market dynamics.

What’s Ahead

As China moves closer to its 2025 target, we can expect:

- More

device categories added to VBP and insurance coverage (e.g., diagnostics,

electrophysiology)

- Increased

use of Health Technology Assessment (HTA) in reimbursement decisions

- Closer

alignment between regulatory approvals and insurance listing eligibility

The message is clear: To succeed in China, reimbursement

strategy is just as critical as regulatory compliance.

Conclusion

China’s healthcare reforms are pushing the boundaries of how

medical devices are priced, procured, and reimbursed. By mandating that

insurers cover devices selected through VBP, the government is ensuring that

cost-effective technology reaches patients—not just in big cities, but across

the entire country.

For medical device companies, this means adapting fast, thinking

locally, and aligning with public health goals. It’s a challenge, yes—but also

a major opportunity in one of the world’s largest medtech markets.

For more information or tailored guidance, contact Titans

Medical Consulting.